With new updates on tariff and counter tariffs coming almost on a daily basis, the last week was one of the most volatile weeks for the Indian equity market in recent times.

After plunging sharply on Monday, the Indian market regained some of the lost ground over the rest of the week. The week had only four trading days, as the stock markets were closed on Thursday on the occasion of Mahavir Jayanti.

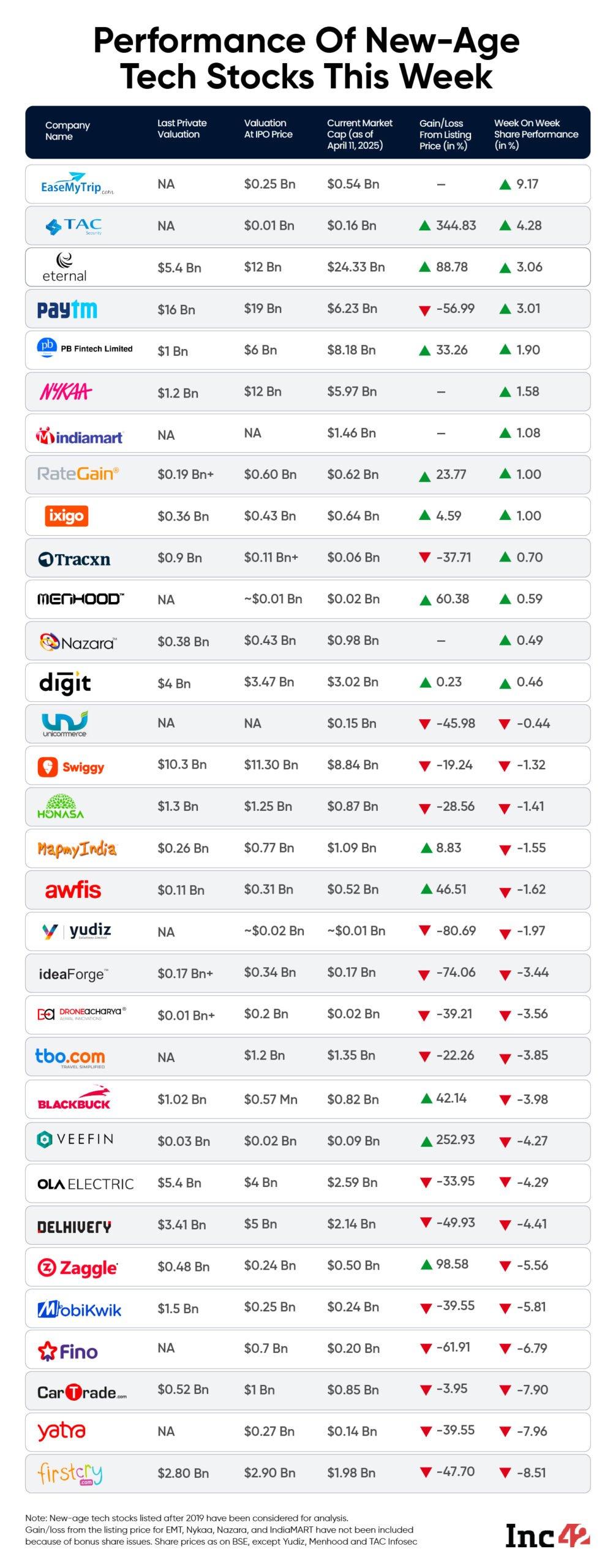

Despite the recovery after Monday’s (April 7) decline, a majority of new-age tech stocks remained under pressure this week. Nineteen out of the 32 new-age tech stocks under Inc42’s coverage fell in a range of 0.44% to under 9% this week.

FirstCry parent Brainbees Solutions took the biggest dent this week, with its shares plunging 8.51% to end Friday’s (April 11) trading session at INR 326.90.

The company’s shares, along with , touched an all-time low of INR 301 on Monday.

Among the list of losers, shares of CarTrade saw intense volatility. After ending Monday’s session down over 12%, the company’s shares during the intraday trade on Friday. Yet, the company’s shares ended the week 7.90% lower from last Friday’s close at INR 1,536.85.

Meanwhile, shares of Bhavish Aggarwal-led Ola Electric crashed 4.29% this week to end at INR 50.19. Amid growing regulatory troubles, the company’s shares touched an all-time low at INR 45.55 this week.

Addressing reports about it counting sales of vehicles for which deliveries weren’t started in its February numbers, Ola Electric said this week that the sales numbers were based on paid and confirmed orders, . Later in the week, it from its factory in Tamil Nadu’s Krishnagiri.

Swiggy, TBO Tek, Honasa Consumer, Fino Payments Bank, ideaForge, Go Digit, ixigo, were among the other losers this week.

Meanwhile, 13 new-age tech stocks ended the week in the green, gaining in a range of 0.46% to over 9%. The top gainer this week was EaseMyTrip, with its shares gaining 9.17% to end at INR 13.09. The gains came after the company’s shares also touched a fresh 52-week low of INR 10.71 on Monday.

Yesterday, the online travel aggregator said that on a preferential basis for a non-cash consideration for acquisition of stakes in various companies.

The list of gainers this week also featured new-age tech companies with the biggest market cap – Eternal, Paytm, PB Fintech.

As a result, the total market cap of the 32 new-age tech companies went up marginally to $74.78 Bn from last week’s $74.75 Bn.

Now, let’s take a deeper look at what happened in the broader market last week.

Tariff Troubles Hit SentimentTariff and counter tariff imposition announcements by China and the US resulted in mood swings in the global equities markets this week.

While the Indian market began the week on a bearish note, sentiment improved significantly in the subsequent sessions after US President Donald Trump deferred imposition of tariffs on all countries, except China, for 90 days.

Further, the RBI cut the repo rate by 25 basis points to 6% this week. On Friday, the central bank also announced that it will purchase government securities worth INR 40,000 Cr on April 17, marking its third open market operation (OMO) purchase of gilts. A significant improvement in Indian rupee value and a weakening dollar also led to an improvement in market sentiment.

Yet, Sensex and Nifty 50 ended the week in the red, both declining 0.3% from last Friday’s close to end at 75,157.26 and 22,828.55, respectively.

However, foreign institutional investors (FIIs) continued their selling in the Indian market. FIIs have sold equities worth INR 31,988 Cr in the month of April so far, taking their total selling in the equity market in 2025 to INR 1.62 Lakh Cr.

“A clear pattern in FPI strategy will emerge only after the ongoing chaos dies down. In the medium term, FIIs are likely to turn buyers in India since both the US and China are heading for an inevitable slowdown as a result of the ongoing trade war. Even in an unfavourable global scenario, India can grow by 6% in FY26,” said Dr. VK Vijayakumar, chief investment strategist at Geojit Investments.

Moving forward, the US-China trade war, the outcome of the ongoing bilateral trade negotiations between India and the US, and the ongoing earnings season would decide the market trends in the following.

With that said, let’s dive into the performance of a couple of new-age tech stocks this week.

Delhivery Confident About Ecom Express AcquisitionLast week, Delhivery announced the for INR 1,407 Cr, about 20% of its last private valuation.

Following this, the stock gained 5% on Monday. However, it declined significantly during the rest of the week. The company’s shares ended the week at INR 246.85, down 4.41% from the previous week. With this, its market cap stood at $2.14 Bn, down about 5% from last week’s $2.25 Bn.

A potential reason driving the bear sentiment was investor skepticism over Delhivery’s integration of Ecom Express.

Delhivery’s $200 Mn acquisition of partial truck load (PTL) logistics platform SpotOn Logistics in 2021 caused significant integration challenges.

However, Delhivery clarified on Friday that the compared to its acquisition of SpotOn.

It added that no new technology integrations will have to be “created or changed” as part of the deal as there is a near total overlap (nearly 100% in customer count and 95% in terms of revenue) between Delhivery and Ecom Express.

Nykaa’s Strong Q4 ProjectionsLast Sunday (April 6), beauty and personal care major for Q4. Nykaa said that its net revenue grew in the low to mid-20% range year-on-year (YoY) in the March quarter.

“Nykaa’s full financial year FY25 revenue growth is estimated to be at similar levels in mid twenties, indicating consistent growth across all quarters of FY25,” the company said.

The company added that the beauty vertical remained the key growth driver, with its gross merchandise value (GMV) projected to grow in the low 30% range, significantly ahead of industry benchmarks, in Q4.

On the back of these projections, Nykaa’s shares gained 1.58% from last week to close at INR 179.65.

The post appeared first on .

You may also like

Trade war: How India could be Trump's trump card in 'encircling' China

'US visa holders should know...': What Marco Rubio's statements on revoking visas mean

Tahawwur Rana was key 26/11 attack conspirator who operated under ISI, LeT: Former ADGP PK Jain

Ooni pizza ovens see rare price cuts ahead of Bank Holiday as spring arrives

Basildon fire: Smoke billows over skyline as crews rush to massive 'grass blaze'